IG

- Country:

United Kingdom

United Kingdom - Us Client:

- Min. Deposit:10 USD

- Max Leverage:1:700

- Spread:0.1

- Forex Licence:BaFin, FCA, FINMA

- Summary

- Our Review

- User Review

IG Advandage and Disadvandage

Advandage

- Regulated in multiple jurisdictions

- Competitive tight spreads

- No minimum initial deposit required

- Wide range of trading instruments & platforms

- Part of a large publicly listed group with more than 40 years of experience

Disadvandage

- No micro lots available

- Limited payment methods

The Company

Established in London the year 1974. IG (formerly IG Index) is a pioneering broker that came up with this concept known as financial spread betting. In addition, IG was the first spread betting company to offer online transactions in 1998.

Presently, the group of companies provides a broad variety of products available for online trading, which are available across a range of platforms. These include contracts for differences (CFDs) on indexes, currency pairs and commodities, stocks as well as spread betting on financials (in both the UK as well as Ireland) and in addition to binary options. In 2014 , the broker introduced execution-only stockbroking within the UK and Ireland before rolling this out across Germany and the Netherlands. Netherlands as well as Germany.

It is also the home of IG Group also owns the North America Derivatives Exchange (Nadex) the top and largest online US exchange, which offers spreads and binary options.

Additionally, the company has been listed on both the London Stock Exchange and the FTSE 250. In actuality, it is the biggest Forex broker that is listed on LSE by market value.

Its UK headquarters are located in the middle of City of London, and the company also has offices for sales in 15 other countries.

IG is an online trading name for IG Markets Ltd. and IG Index Ltd that is authorized and regulated by the UK’s Financial Conduct Authority (FCA). For bets on binary options, IG Index Ltd. is also licensed and is regulated under the Gambling Commission.

Security of Funds

The UK’s financial watchdog is renowned for its strict requirements for brokerage companies. Companies licensed by the regulator must follow specific rules and procedures that cover the client’s funds as well as order execution, a minimum capital requirements of EUR730 000, regular report submission, etc.

Regarding the protection of the funds of clients We would also like to note that brokers that are regulated by FCA are part of Financial Services Compensation Scheme (FSCS) which provides protection to customers with up to PS50,000 per individual in the event that a company fails to pay its debts.

In addition to the two previously mentioned companies apart from them, the IG Group has units regulated by relevant authorities of a variety of countries.

Trading Conditions

Minimum Initial Deposit

Customers of IG do not have to make a deposit of a specific initial amount to establish an account at IG However, they must to deposit funds into their accounts to begin trading. For example, in order to purchase 1 lot of USD/GBP (1 deal is 100,000 PS and margin rate is 0.5 percent) It is necessary to put down at least PS500.

Average Spreads & Commissions

IG offers low-cost spreads that are competitive that average between 0.6 percent on EUR/USD accounts that are commission-free, and lower on DMA accounts (which include the commission). The price is very competitive considering that most brokers have spreads in the interval of 1.0 1.5 – 1.5 pips.

Comparatively, FxPro offers average spreads of as low as 0.4 pip on the EUR/USD pair for its cTrader accounts , and costs $4.5 for each lot. For more details you can also take a look at the live spreads for 15 of the major broker here.

Leverage

Maximum leverage amounts provided by IG is 1:200. This is considered to be average. But some FCA-regulated brokers have more leverage ratios. FxPro For instance, provides leverage as high as 1:500.

We want keep traders in mind that greater leverage comes with more risk, not just the chance of multiplying profits made on a tiny deposit. This is a coin that has two sides.

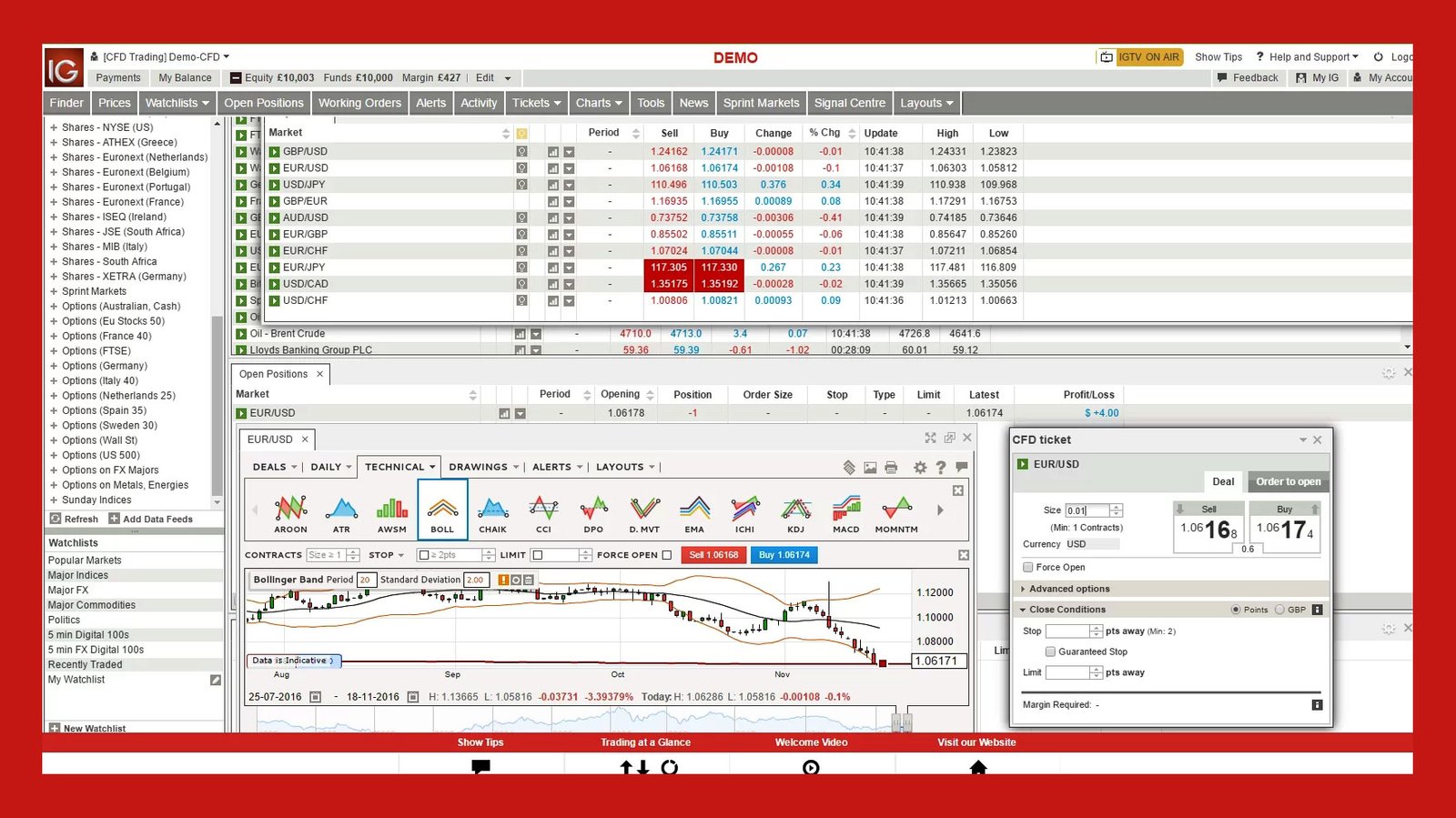

Trading Platforms

The broker provides a variety of highly-rated platforms, including its own IG platform, its web-based ProRealTime and a unique DMA platform called L2 Dealer, and its industry standard MetaTrader 4 (MT4).

ProRealTime is a web-based application. ProRealTime can be customized in its layout and comes with a variety of charting software. over 100 indicators that cover everything from volatility to price Automated trade options, as well as an extensive archive of historical information.

For those looking to have the full market coverage with Direct Market Access (DMA) for FX, share trading and equity CFDs IG provides the L2 downloadable Dealer platform. It offers greater liquidity for shares through the use of principal exchanges as well as brokers, market makers as well as MTF dark pool. With L2 Dealer, investors can make basket trades by using the Excel-compliant ‘Watchlist Pro’ function, which allows them to autotrade using the algorithms they’ve created using Excel and make informed choices based on the market-linked news feeds, as well as live charts.

Furthermore traders who are accustomed to the classic MetaTrader 4 is able to utilize it together with IG.

Methods of Payment

Customers of IG UK can to deposit and withdraw funds through credit/debit cards, and wire transfer. Popular e-wallets like BPay and Chinese UnionPay as well as Paypal are also offered as payment options through this broker.

Conclusion

Being part of an international company with more than 40 years of industry experience, IG is a reliable and well-regulated broker. It offers the best trading conditions in a many financial instruments across a variety of platforms.

IG Overview

| IG Summary | |

|---|---|

| IG Details | Information |

| Regulators | BaFin, FCA, FINMA |

| Country |  United Kingdom United Kingdom |

| Base Currencies | USD |

| Type Of Brokers | ECN, STP |

| Trading Platform | Desktop, Mobile, MT4 |

| Established Year | 1974 |

| Website Language | English |

| US Clients | |

| IG Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | 0.1 |

| Commission | |

| Fixed Spreads | |

| IG Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  Visa Card, Visa Card,  Master Card, Master Card,  Wire transfer Wire transfer |

| Acc Withdrawal Methods |  Visa Card, Visa Card,  Master Card, Master Card,  Wire transfer Wire transfer |

| IG Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| IG Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 1:700 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | 10 USD |

| Islamic Account | |

| IG Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| IG Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | 0800 1953100 |

| sales.ae@ig.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | N/A |