GetStocks

- Country:

- Us Client:

- Min. Deposit:$0

- Max Leverage:00

- Spread:N/A

- Forex Licence:

- Summary

- Our Review

- User Review

GetStocks Advandage and Disadvandage

Advandage

- CySEC regulation

- Competitive commissions

- Social Trading available

- Simple platform

Disadvandage

- Very simple charting

- Lack of clarity on the commission saving “bundle”

The Company. Security of Funds

GetStocks is an online brand that is which is owned by GS Sharestocks Ltd, a Cyprus-based business, managed by CySEC (the Cyprus Securities and Exchanges Commission). The company also owns another broker, invest.com.

Your funds’ security can be almost guaranteed at GetStocks because they are regulated by an EU watchdog. Like all businesses that are regulated by CySEC are, they keep your account balance in separate accounts. They cannot just accept your funds and offer the virtual trading environment. In addition, because it’s a real-stocks broker, every trade have to be made through the exchange designated (this does not happen for CFDs).

Furthermore, GetStocks makes up part of an investor compensation program in Cyprus. If, for any reason, the broker is not able to reimburse you the fund will pay claims of up to EUR20,000.

Like their name implies, GetStocks allows stock trading. It is done with no the need for margin i.e. you own 100% of the shares that you planned to purchase. Today, certificates are usually issued in paper format and when you work with a licensed broker, you can enjoy the same benefits.

However, Contracts For Difference (or CFDs) are also available. As of the writing this review this was done through the brand’s other name, invest.com.

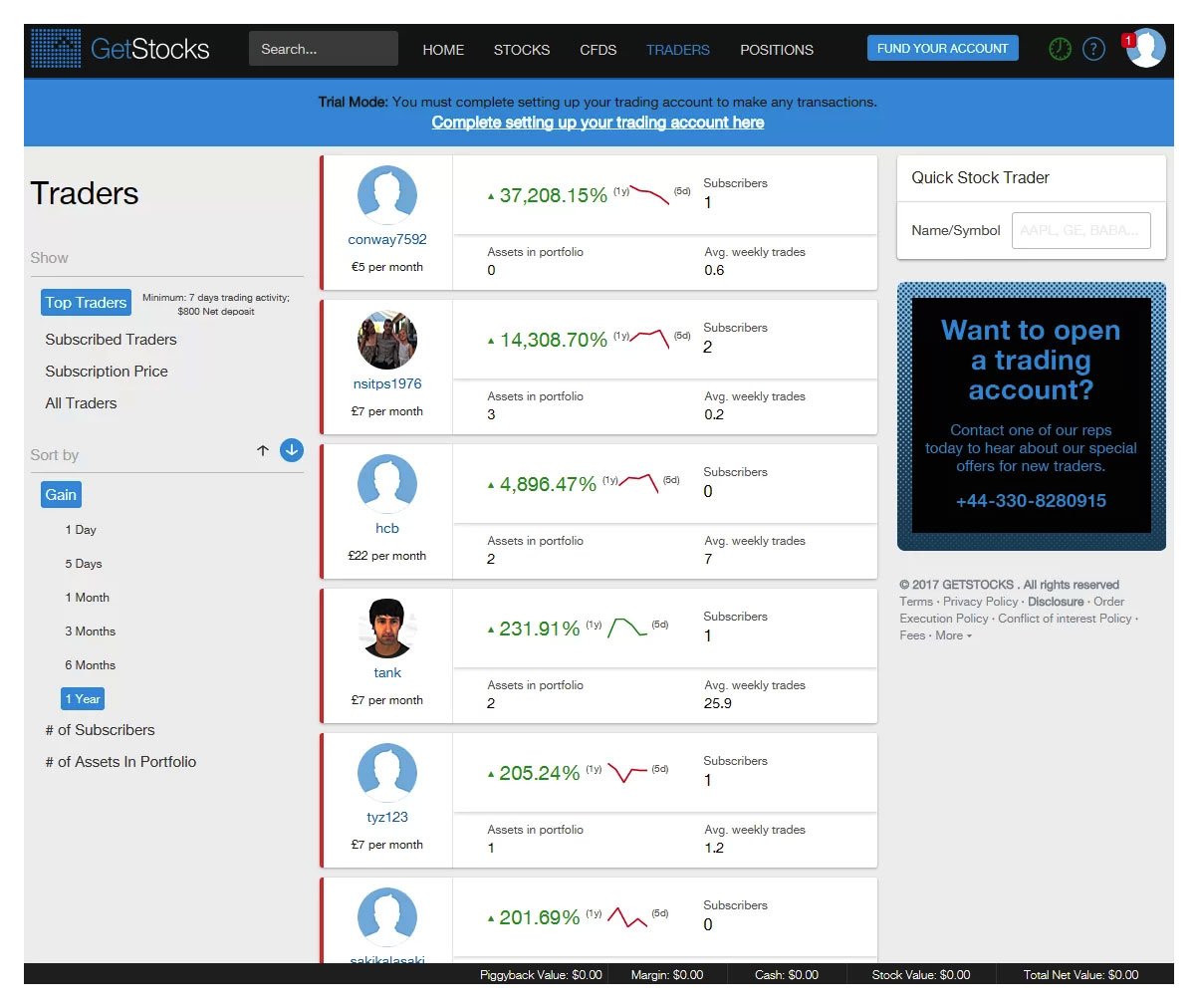

GetStocks also provides a social trading feature, affectionately called “Piggyback copy trading”. You might be familiar with similar services such as eToro the largest social trading platform which allows experienced traders to communicate their trading activities. This helps to create a history through which you can look over the different accounts and decide which one to follow. Here’s a look at the current trader are at GetStocks are:

Although their story is brief and could be inaccurate, the amount of participants will increase in the coming years.

It is essential to mention that one should have at minimum $1,000 in the account to “piggyback” of the ideas of other traders. This happens in this manner since scaling may be an issue if your account isn’t big enough.

Trading Conditions

Supported Exchanges

At present, just the UK (LSE, AIM) and US(NYSE, NASDAQ, ARCA) exchanges are accessible on GetStocks. While they do not offer more options than other brokers, at a minimum they are the two most popular and lively exchanges.

Minimum Initial Deposit

The minimum deposit for GetStocks can be as low as $100. It’s the standard for the forex market as well as CFD brokerages. For example, FxPro demands this type of deposit to facilitate the creation of a brand new account. For investing in stocks that are not leveraged this is a minimal threshold, as most brokerages require at minimum one thousand dollars.

Commissions

The structure of commissions at GetStocks differs for both markets that they cover.

In the case of US shares that are traded on the US market, they cost USD 0.007 per share. This is accompanied by a an initial minimum of 7.50 per transaction.

For UK stocks, the cost is 0.12 percent of the volume of transactions, with an minimum of PS7. We’re not sure whether this fee includes duty stamp tax, however most brokerages do not include it into their charges.

Furthermore, two packages to save money are offered such as:

There is however a striking absence of clarity regarding the specifics of the deal.

In general, the costs are competitive with other options. For instance, Saxo Bank has an average of $0.02 per share, with minimum of $15.

Inactivity fee

GetStocks doesn’t charge an inactivity fee for inactivity. It is fast becoming the norm when it concerns brokers for stocks, even though certain companies charging up to $50 per month if no transaction has taken place. Although this seems reasonable for the business, since they earn money from commissions, today the competition for stock brokers is competitive.

Leverage

Real-stock trading is when you’re willing to purchase shares in a business without any leverage. As we have mentioned when you click on the CFD trading button now takes you to invest.com another brand that is that is owned by the same firm. From the marketing materials CFD trading is offered on GetStocks with leverage ratios to 1:120 (for stock).

You may have noticed greater ratios provided by other brokers, but they don’t apply to stock trading. This could be because of the different between asset classes. Stock trades are more vulnerable than foreign exchange for instance, if executed with the same nominal size transactions.

Trading Platforms

Trading on GetStocks can be done on their website or through their mobile application. After logging into the platform, you’ll be able to see the main control panel. It appears like the following:

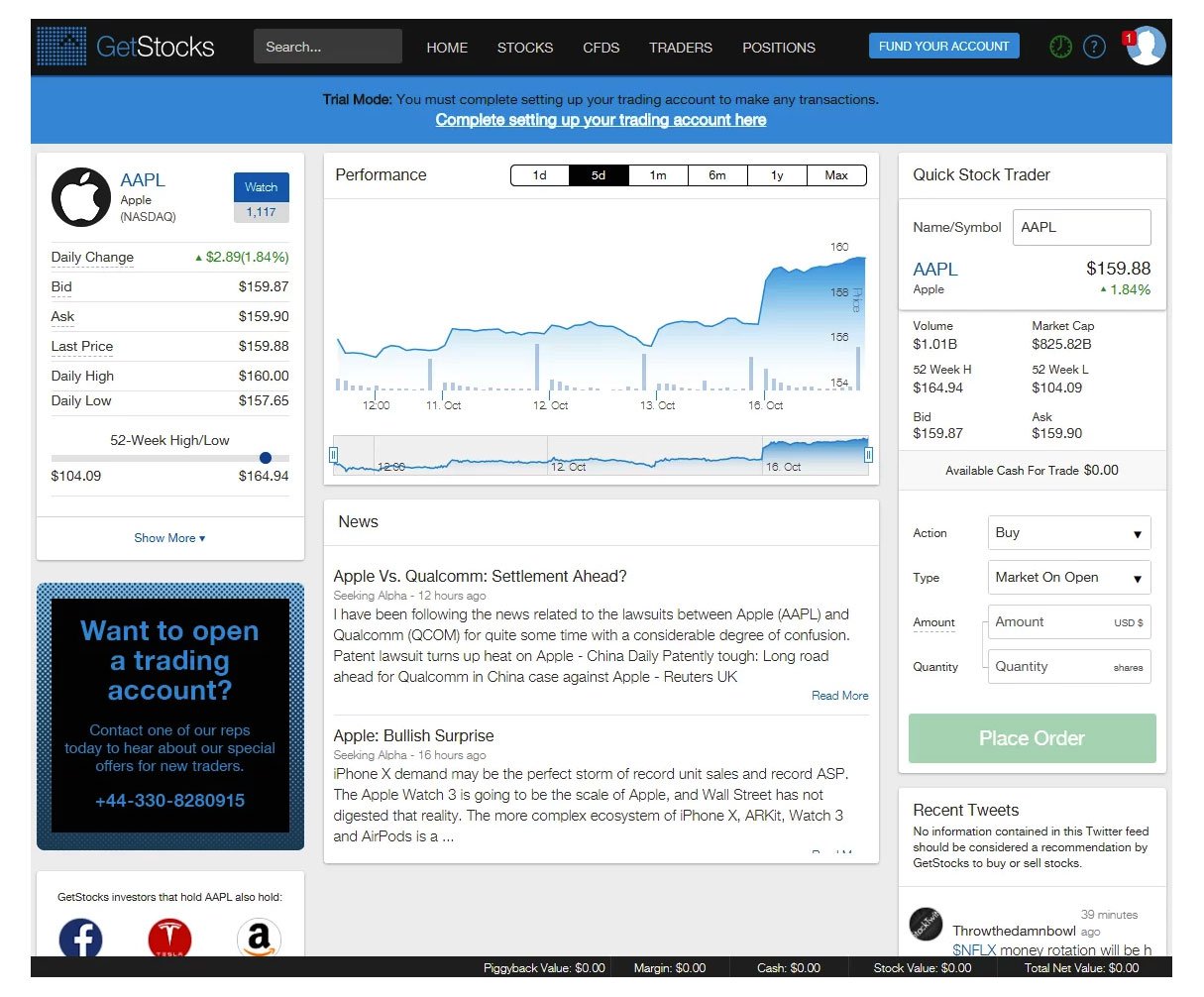

When you visit”stocks,” or the “stocks” page, you will find a list of top equities as well as the option to search. When you are looking at a particular stock, you can see this picture:

This might not sound like much, but for technical analysts who prefer superior charting (like that offered by Meta Trader 4 as well as TradingView). However, the news panel as well as Twitter integration are very beneficial in a fundamental sense. However, they do not replace traditional research.

Methods of Payment

The only methods currently accepted of payment on Getstocks are wire Transfer along with Credit/Debit card. Although e-wallets like Skrill aren’t typically accepted by brokerages, today businesses are ready to incorporate various methods to attract customers.

Conclusion

GetStocks offers an on-line stock brokerage that provides access to US as well as UK markets. The company that is behind this initiative is overseen through CySEC (and also is the owner of invest.com). The prices for trading on GetStocks are competitive, however the minimum limitations could hinder small traders. A social trading option is also in place. In this regard, this whole project appears be brand new, and we might revisit this review in the near future.

GetStocks Overview

| GetStocks Summary | |

|---|---|

| GetStocks Details | Information |

| Regulators | |

| Country | |

| Base Currencies | |

| Type Of Brokers | N/A |

| Trading Platform | N/A |

| Established Year | 2021 |

| Website Language | English |

| US Clients | |

| GetStocks Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | N/A |

| Commission | |

| Fixed Spreads | |

| GetStocks Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  Skrill Skrill |

| Acc Withdrawal Methods |  Skrill Skrill |

| GetStocks Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| GetStocks Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 00 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | $0 |

| Islamic Account | |

| GetStocks Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| GetStocks Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | +44-3308280915 |

| support@getstocks.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | N/A |