C.I.M Banque

- Country:

Switzerland

Switzerland - Us Client:

- Min. Deposit:100 USD

- Max Leverage:1:200

- Spread:0.5

- Forex Licence:

- Summary

- Our Review

- User Review

CIM Banque are an international online financial trading platform, as well as an asset broker created in 1995. More than 26 years later, CIM Banque has grown to provide retail investors with Trading in Forex, trading CFDs along with trading. CIM Banque are a global broker. CIM Banque have a headquarters located in Geneva.

C.I.M Banque Advandage and Disadvandage

Advandage

- Used by over 10,000 CIM Banque users and traders

- Regulated by Financial Industry Regulatory Authority (FINRA), Securities and Exchange Commission (SEC), Securities Investor Protection Corporation (SIPC)

- Min. deposit from $100

Disadvandage

- Doesn't allow scalping

- Not FCA Regulated

CIM Banque is a Multi-Assets Trading Platform with over 74+ Assets

CIM Banque is a multi asset platform that has more than 74 tradable assets. Assets available on CIM Banque include Forex trading, CFD trading.

CIM Banque trades in multiple financial asset types. A financial asset is any tangible or intangible asset or intangible that has financial value. This implies it is Forex trading as well as CFD trading and CFD trading can be classified as financial assets.

Features of CIM Banque

- Virtual Portfolio , or what’s often referred to as an Demo Account. Demo Account

- CIM Banque offers Advanced Financial Chart Comparison tools

- CIM Banque offers Research-backed analysis on the financial market and investments by the top analysts

- CIM Banque is a CIM Banque Platform can be used across a range of devices, which include Apple Mac computers as well as online via the Internet Browser.

- CIM Banque offers an easy to use trading platform that includes tools that are suitable for new traders as well as Experienced Experts.

- CIM Banque users benefit from using the CIM Banque platform in over 15 languages

What you need to be aware of

CIM Banque offer three ways to trade forex: trading in Forex, CFD trading, .

For CIM Banque you will need at least $100 in deposit. You can join an online trial account to familiarize yourself with the CIM Banque’s Banque platform.

CIM Banque are able to accommodate traders of all levels regardless of whether you’re an experienced trader or are a novice.

Are CIM Banque safe?

When selecting a broker such as CIM Banque CIM Banque, the legal and administrative condition of the broker are vital. Brokers who trade without the supervision from a regulatory body are doing so at their discretion. All capital you put in could be at risk.

The company was founded in 1995 and has been running for the past 26 years. CIM Banque has an office in Geneva.

CIM Banque is regulated. This means that CIM Banque are supervised by and is inspected for compliance with CIM Banquet’s Financial Industry Regulatory Authority (FINRA), Securities and Exchange Commission (SEC), Securities Investor Protection Corporation (SIPC) the regulatory bodies.

Regulated brokers do not influence the market price. If you submit your request for withdrawal CIM Banque CIM Banque, the request will be granted. In the event that CIM Banque violate any regulatory regulations, their status may be removed.

Educational resources available on CIM Banque

For a successful trade using CIM Banque, it is essential to grasp of how to use the CIM Banque trading tools and the market. Be sure to make use of all educational tools. This includes educational tools that are integrated that integrate with CIM Banque and externally.

CIM Banque offer an extensive collection of educational resources. Spend time learning how financial markets change. Make sure you know how your trading platform functions. Create buy and sell trades Learn how to profit from worldwide trading hours, and, most importantly, learn how to reduce and manage investment risk.

A more analytical approach might be an effective option to approach trading CIM Banque.

Spend some time looking around your CIM Banque platform and learn to think more clearly and in a rational manner about the markets. This is a new set of skills for many, yet it’s what the market demands of you.

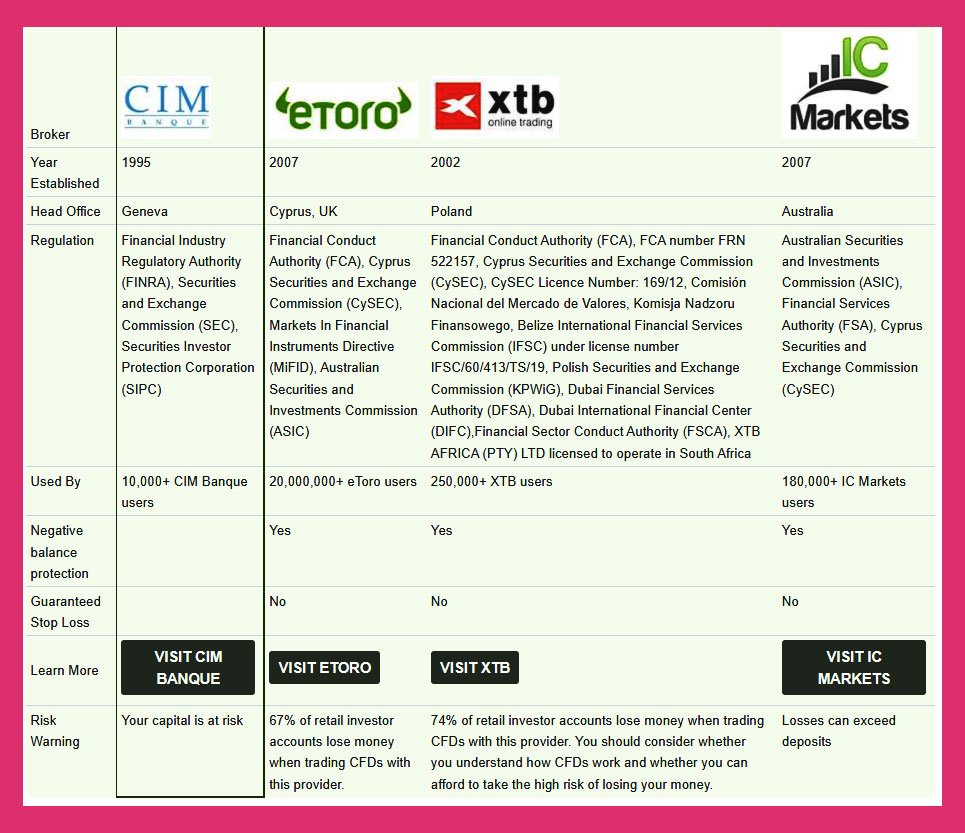

How CIM Banque as a Company Compare Against Other Brokers

C.I.M Banque Overview

| C.I.M Banque Summary | |

|---|---|

| C.I.M Banque Details | Information |

| Regulators | |

| Country |  Switzerland Switzerland |

| Base Currencies | USD |

| Type Of Brokers | ECN |

| Trading Platform | Desktop, Mobile, MT4 |

| Established Year | 2017 |

| Website Language | English |

| US Clients | |

| C.I.M Banque Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | 0.5 |

| Commission | |

| Fixed Spreads | |

| C.I.M Banque Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  Skrill, Skrill,  WebMoney, WebMoney,  PayPal, PayPal,  Master Card, Master Card,  Visa Card Visa Card |

| Acc Withdrawal Methods |  Skrill, Skrill,  WebMoney, WebMoney,  PayPal, PayPal,  Master Card, Master Card,  Visa Card Visa Card |

| C.I.M Banque Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| C.I.M Banque Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 1:200 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | 100 USD |

| Islamic Account | |

| C.I.M Banque Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| C.I.M Banque Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | + 41 58 225 50 50 |

| info@cimbanque.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | Etzelstrasse 17 8832 Wollerau Schweiz |