OANDA

- Country:

United States

United States - Us Client:

- Min. Deposit:1 USD

- Max Leverage:1:50

- Spread:0.1

- Forex Licence:CFTC, DFSA, NFA, FSA, IIROC

- Summary

- Our Review

- User Review

OANDA Advandage and Disadvandage

Advandage

- Variety of platforms offered

- Mt4 available

- No initial deposit required

- No minimum trade size

- No commission and account maintenance fees

- Well-regulated

Disadvandage

- Market maker

- Low maximum leverage

The Company

OANDA is among the first forex brokers online. It was established in 1996. it is now a huge company with branches across Toronto, San Francisco, New York, London, Singapore, Tokyo, and Sydney. ALL members are monitored by the relevant agencies in US, Singapore, Canada and Canada, Singapore UK, Japan and Australia.

OANDA provides online forex trading and information on currency to both institutional and retail clients. It operates as a market maker boasting one of the biggest currencies databases on the planet. The portfolio of products comprises index, forex CFDs for bond, commodity and bond along with precious metals.

Security of Funds

OANDA Corporation is a registered Futures Commission Retail and Merchant Foreign Exchange Dealer in the Commodity Futures Trading Commission and is an active participant in the National Futures Association.

Brokers who are associated with NFA are required to follow a stringent set of regulations. However, these rules tend to be restrictive from the perspective of traders’ perspective, however there is no way to circumvent these rules. For instance, hedges are not permitted and leverage is restricted to 1:50. European brokers can offer leverage up to 1:1000, or even more than that.

Additionally, NFA-registered brokers must be required to have an amount of net capital not less than $20 million in order to protect their clients’ positions and make them secure to invest in. The same minimum requirements for capital for brokers are applicable in all countries For instance, British-based brokerages are required to have at 730 000 EUR to demonstrate their financial stability. Australian brokers must have at least $1 million in order to function legally.

All OANDA Subsidiaries which include OANDA Asia Pacific Pte. Ltd. (Singapore), OANDA (Canada) Corporation ULC (Canada), OANDA Europe Limited (UK), OANDA Japan Inc. (Japan) and OANDA Australia Pty Ltd. (Australia) are legally licensed and monitored by the respective authorities.

Trading Conditions

Minimum Initial Deposit

OANDA does not have minimum deposit requirements to open an account. This is a plus for those who are cautious or novice traders who do not want to risk a significant amount of money.

Many brokers require a minimum deposit to cover the cost for opening a brand new account. For example, Forex.com demands $250 from its clients at the beginning as well as FXCM requires $50.

Average spreads and Commissions

The broker provides various spreads and the median spread for EUR/USD are 1.4 pip which is at the high end of average. Customers, however, can profit from commission-free trading since OANDA does not charge commissions for their trading services or any fees for account maintenance. In fact, OANDA receives its commission through spread.

Comparatively, FOREX.com, is also a FSA-regulated global brokerage and market maker has an average spreads of 1.8 pip on USD/EUR and does not charge commission fees. You can find live spreads for 15 top brokerages here.

Maximum Leverage

OANDA has the maximum leverage of 1:50 for FX products which is quite minimal, but the broker doesn’t have a choice to limit leverage, as the US regulators have established a limit to leverage ratios. CFTC limit leverage offered to traders who trade forex retail across the United States to 1:50 on major currency pairs, and 20:1 for other pairs.

If you are looking for a greater leverage, then you should choose one that offers leverage ratios between 1:500 and over 1:500 from these choices. We suggest traders use caution when using leverage levels as such rates could not only increase their profits on a tiny deposit, but could also result in losses that are far over the initial investment made.

Trading Platforms

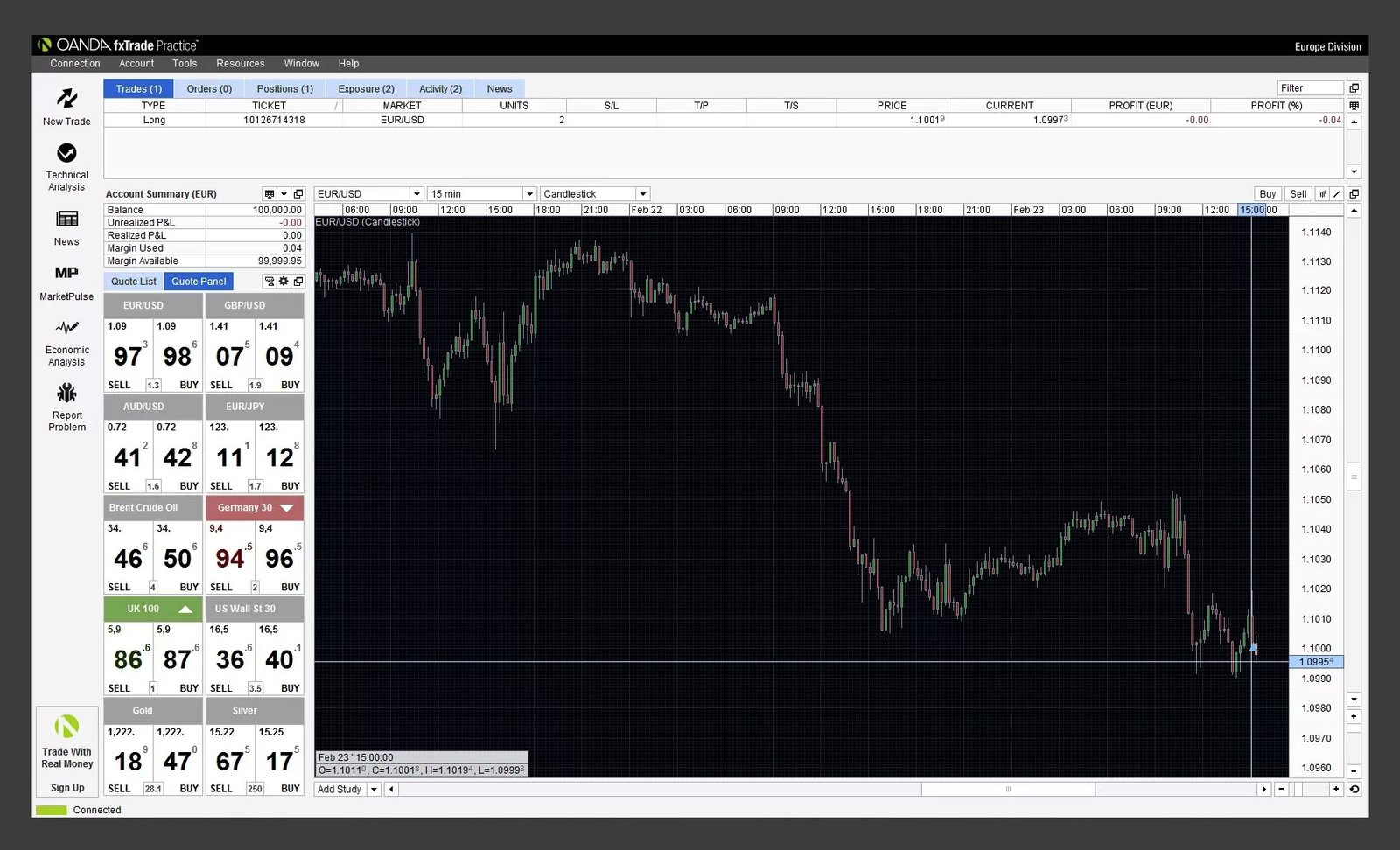

Oanda gives its customers a three trading platforms, including its own custom-designed fxTrade, Protrader Multi-Connect (PTMC) and the well-known MetaTrader 4.

fxTrade can be downloaded with desktop, web and mobile variants. It is a simple, but effective interface, and more crucial is the incredible execution speed. According to the OANDA website, this platform is able to execute 98% of trades in 0.057 minutes or less. This is incredibly fast.

Additionally, fxTrade comes with powerful and intuitive charting tools and multiple sub-accounts that allow you to test various trading strategies, and market research and news from top news outlets.

We believe that fxTrade is targeted at beginners, as it comes with all the standard functions, however more sophisticated features aren’t available.

Oanda’s proprietary fxTrade. Click to expand.

Oanda recently expanded its portfolio of platforms up Protrader created by PFSOFT. Protrader provides everything that standard forex trading platforms provide advanced charts and analytical tools, indicator, different kinds of orders, options for customization as well as auto trading options. In reality, Protrader has created AlgoStudio, a professional algorithmic strategy development tool. It lets users try different types of data aggregation techniques: time ticks, range, Renko, LineBreak, etc.

Additionally, Oanda offers the powerful MetaTrader 4, which is highly appreciated by the community of online traders mostly due to its ability to completely automate their trading. With a broad variety of Expert Advisors (EAs) traders are able to rest and relax, and let the software do everything. Furthermore it provides a variety of indicators that are technical, a comprehensive back-testing capabilities and a sophisticated charting tools. Here’s an overview of other forex brokers who offer the MT4 platform.

Additionally, fxTrade bridges directly to MetaTrader 4 with custom-built technology that we have found beneficial.

Methods of Payment

OANDA offers customers a variety of ways to transfer funds into as well as from their account. The methods vary based upon your OANDA section of registration. The principal payment methods are debit/credit card banks wire, cheques, PayPal and UnionPay.

Conclusion

OANDA is a world-class forex broker, providing online trading across a broad variety of CFDs, currency pairs and precious metals at appealing conditions.

OANDA Overview

| OANDA Summary | |

|---|---|

| OANDA Details | Information |

| Regulators | CFTC, DFSA, NFA, FSA, IIROC |

| Country |  United States United States |

| Base Currencies | EUR, USD, GBP |

| Type Of Brokers | ECN, STP |

| Trading Platform | Desktop, Mobile, WebTrader, MT4 |

| Established Year | 2011 |

| Website Language | English, Chinese, Spanish |

| US Clients | |

| OANDA Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | 0.1 |

| Commission | |

| Fixed Spreads | |

| OANDA Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  Wire transfer, Wire transfer,  Visa Card, Visa Card,  Master Card Master Card |

| Acc Withdrawal Methods |  Wire transfer, Wire transfer,  Visa Card, Visa Card,  Master Card Master Card |

| OANDA Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| OANDA Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 1:50 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | 1 USD |

| Islamic Account | |

| OANDA Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| OANDA Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | +1 212 858 7690 |

| frontdesk@oanda.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | 795 Folsom St Floor 1, Suite 1038 San Francisco, CA 94107 |