TeleTrade

- Country:

Cyprus

Cyprus - Us Client:

- Min. Deposit:1 USD

- Max Leverage:1:500

- Spread:0.8

- Forex Licence:CySEC

- Summary

- Our Review

- User Review

TeleTrade (Europe) provides its customers a option of three account kinds. They all offer leverage of up to 1:100, and the minimum amount of trade is 1 normal lot (100,000 units of base currency) that is not common.

TeleTrade Advandage and Disadvandage

Advandage

- Well-regulated award-winning broker

- Both MT4 and MT5 offered, advanced copy trading options with Investment Synchronous Trading

- Part of international group with more than 20 years of experience

- Wide range of financial instruments offered

- NDD environment available

Disadvandage

- High minimum initial deposit required

- Mediocre leverage levels

- No micro tradeable lots

- Overall pricing is not very competitive

The Company. Security of Funds

TeleTrade (Europe) provides trading in foreign exchange and contracts for differences (CFDs) on stocks, commodities futures, currencies and futures for both MT4 as well as MT5. The company that operates the brand name, DJ International Consulting Ltd. is an Cyprus Investment Firm that is authorized by the Cyprus Securities and Exchange Commission (CySEC) since. It has also been registered with the appropriate agencies in UK, Bulgaria, Romania, Germany, Spain, Italy as well as the UAE. The company’s subsidiary (TeleTradeBel) was also obtained an authorization from Belarus National Bank in 2016. Belarus National Bank in 2016,

The Cypriot financial watchdog enforces specific regulations and rules for Cyprus Investment Firms and sees the compliance of their firms. For instance, they need to keep a net tangible asset of at least 730,000 euros to show the stability of their finances. Furthermore, CySEC requires forex brokers to ensure that customer funds are kept in separate accounts, and separate from the business’s operating funds.

In addition to a guarantee for the funds of clients All CySEC-regulated businesses are part of the Investor Compensation Fund, which will pay compensation of up to $20,000 EUR for each person. in the event that the company is declared insolvent.

Additionally, every CySEC-regulated financial company is MiFID certified and thus able to offer cross-border service across every EU Members States.

TeleTrade Europe is part of TeleTrade Group of Companies with more than 20 years, and has more than 200 offices across 30 countries, and more than 3000 employees. TeleTrade is among the three brokerages for forex with a license from the Central Bank of Russia (CBR) and is licensed by the National Bank of the Republic of Belarus (NBRB), which is equivalent to receiving approval.

Trading Conditions

Minimum Initial Deposit

To sign up for an account at TeleTrade investors must put down an initial minimum of $2000. The minimum amount for initial investment is quite high considering that the majority of brokers need lesser. For instance, the top Cypriot firm FXTM requires just $5 from its customers for a starting point.

Spreads & Commissions

TeleTrade provides floating and fixed spreads. Fixed spreads are somewhat expensive for their MT4 platform, averaging 3 pips in EUR/USD, and the average for MT5 2 pips. Regarding the spreads that are variable the spreads are quite restrictive, beginning at 0.1 percent for the EUR/USD pair however, a fee of $14 is charged roundtrip, which means that the total cost of trading per lot is more than 1.5 pips. This is not price that is competitive, since the majority of brokers offer spreads that range from 1.0 to 1.5 pips for the EUR/USD currency pair.

For comparison, FXTM’s ECN spreads average 0.7 pip on EUR/USD. They also include a commission of $4 per typical lot (round trip).For more information, check live spreads from fifteen of the most popular brokers here..

Leverage

The maximum leverage provided by TeleTrade is only 1:100 which is a low ratio. Many brokers provide significantly more leverage levels, for instance, FXTM provides leverage as high as 1:1000. For more details look up the list of brokers that offer leverage of or greater than 1:500.

Leverage lets traders control huge amounts of capital however, if it is not utilized together with a good risk management plan, it could cause significant losses.

Trading Platforms

As we’ve already discussed, TeleTrade offers both MetaTrader4 (MT4) and its successor, MetaTrader 5 (MT5).

MT4 is a renowned international trading terminalthat provides the full range of tools and resources for trading that include More than 50 of the built-in indicators for technical trading, a sophisticated charting software, a broad selection of Expert Advisors (EAs) as well as an extensive set of back-testing tools. The traders can download ready-made EAs or design your own EAs while letting the software complete the task.

TeleTrade is also compatible with metaTrader 5. which is a flexible and robust trading platform that has gained a lot of attention in recent times, especially since the hedge option was added to the platform. MT5 allows for the execution of orders across a variety of stocks and financial exchanges with an account for trading. It comes with an advanced charting software as well as trading and analysis tools as well as alerts, signals and indicators that can be customized.

Additionally being a plus, in addition, the MQL5 development environment permits traders to develop trading robots and analytical indicators on their own, as well as the pre-made ones.

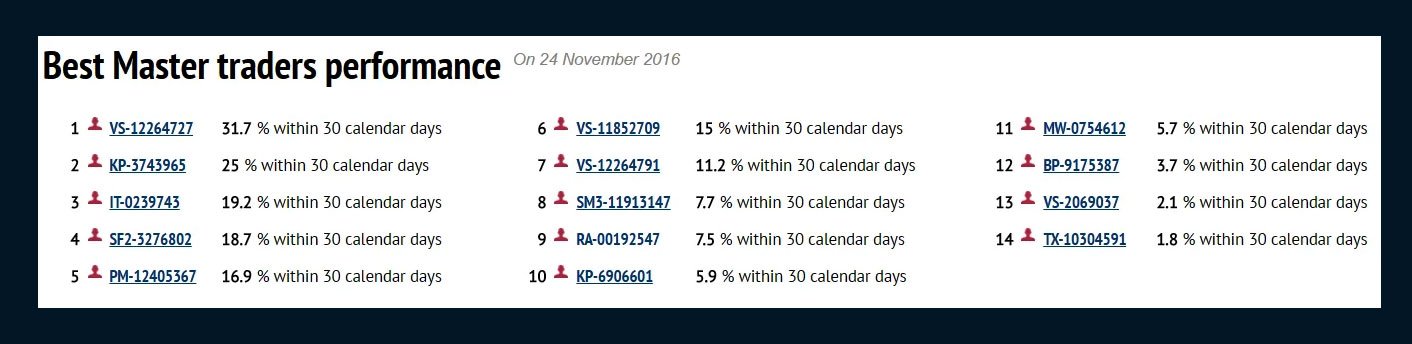

Additionally, TeleTrade has developed its own social trading system that is called Investment Synchronous Trading. It allows you to access the expertise and knowledge of our top clients, called Master Traders. They are traders who have proven trader skills and experience. you can copy their trades using the MT4 and maintain complete control, transparency and flexibility in your personal trading account.

In the event of a successful transaction that is copied to the Investor’s investment account the Master Trader will be compensated by way of an amount of commission.

Methods of Payment

The following payment options are accessible to TeleTrade customers: credit or debit cards or bank wire transfer as well as electronic-wallet payment methods like Skrill, Neteller and SafeCharge.

Conclusion

TeleTrade (Europe) forex & CFD broker that has solid regulation. It offers immediate execution as well as market as well as adjustable and fixed spreads as well as MT4 as well as MT5. The overall price, however, isn’t competitive.

TeleTrade Overview

| TeleTrade Summary | |

|---|---|

| TeleTrade Details | Information |

| Regulators | CySEC |

| Country |  Cyprus Cyprus |

| Base Currencies | USD, EUR |

| Type Of Brokers | ECN, STP |

| Trading Platform | Desktop, Mobile, MT4, MT5 |

| Established Year | 2011 |

| Website Language | English, Chinese, Italian |

| US Clients | |

| TeleTrade Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | 0.8 |

| Commission | |

| Fixed Spreads | |

| TeleTrade Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  Skrill, Skrill,  Visa Card, Visa Card,  Master Card, Master Card,  Wire transfer Wire transfer |

| Acc Withdrawal Methods |  Skrill, Skrill,  Visa Card, Visa Card,  Master Card, Master Card,  Wire transfer Wire transfer |

| TeleTrade Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| TeleTrade Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 1:500 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | 1 USD |

| Islamic Account | |

| TeleTrade Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| TeleTrade Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | +35722314160 |

| support@teletrade.eu | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | 88 Archiepiskopou Markariou III, 1077 Nicosia-Cyprus |