Plus500

- Country:

United Kingdom

United Kingdom - Us Client:

- Min. Deposit:$100

- Max Leverage:1:30

- Spread:N/A

- Forex Licence:ASIC, CySEC, FCA

- Summary

- Our Review

- User Review

Plus500 has one type of account with an eleverage of up to 1200 fixed spreads, as well as the option to trade through small lots to help manage risk better,

Plus500 Advandage and Disadvandage

Advandage

- Strong regulation, publicly listed brokerage

- No commission fees on CFDs

- Guaranteed stop loss available

- Negative balance protection

Disadvandage

- Only one trading platform available, no MT4

- No automated trading platform available

- Fixed spreads only

The Company. Security of Funds

Plus 500 specializes in Contracts for Difference (CFDs) and offers trading options on commodities, shares, forex ETFs, options, and indexes. It is a broker based in the United Kingdom. licensed and regulated through one of the world’s most trustworthy financial authorities that is The Financial Conduct Authority. In addition to an annual capitalization requirement in the amount of EUR 730 000 that is standard for EU states, FCA certified brokers are required to adhere to various rules and regulations – including reporting to commissions and keeping client funds in separate accounts, and so on. Additionally is that customers of UK licensed brokers are covered through a compensation scheme known as that is the Financial Service Compensation Scheme (FSCS) that covers that can be as high as GBP 50 000 in the event that a licensed firm is declared bankrupt.

Additionally, Plus500UK Ltd. is listed on the London Stock Exchange and is actually one of the top retail FX brokers by market capitalization. Publicly traded companies must comply with strict standards as well as be subjected to stringent regulations and rules. They are required to regularly release certain business and financial information which makes them extremely trustworthy.

It is also a part of the Plus 500 group also has subsidiaries operating and properly controlled that are regulated in Cyprus in addition to Australia, Israel, Singapore, South Africa and New Zealand .

Presently, Plus 500 offers its portfolio that includes more than 2000 instruments. Contracts for Differences enable investors to gain from an index, stock ETF, forex, or commodity investment without the requirement to have the asset in question. In addition it, the company is the principal sponsor of the renowned Spanish soccer team Atletico Madrid.

Trading Conditions

Minimum Deposit

The minimum deposit for Plus500’s customers is PS100 which is the standard. Other UK brokers require $500 (FxPro) or $50 (FXCM). There are brokers that don’t require an initial trader deposit like CMC Markets.

Maximum leverage

The maximum leverage can also differ based on the instruments used:

Forex with leverage up to 1:200;

Indices up to 1:294 leverage;

Commodities that are priced at 1:150 leverage

ETFs can be leveraged that can leverage up to 1:100.

The leverage rates can also be considered to be average, because FxPro for instance, provides leverage of up to 1:500 while FXCM can go 1:200, and XM, with a maximum of 1:888. However, traders must be aware of leverage rates that are higher because it can boost their profits and could cause significant losses. This is the reason why restrictions on the leverage rate are established in a variety of countries: 1:50 in the USA 1:25 in Japan 1:100 in Poland.

Spreads & Commission

The spreads provided by Plus500 can be fixed and the average spread for EUR/USD is up to 2 pip. To give you an idea of the spread the spread offered by FXPro’s average spread on EUR/USD is approximately 1.8 pip and XM has spreads that vary from 1 pip on EUR/USD.

In contrast to others CFD broker, Plus500 does not charge commissions for trades in CFDs ( CMC Markets for instance, requires the payment of a commission rate of 0.10 percent of the amount traded). Instead the broker gets paid for its services via”market spread” “market spread”.

Risk Management Options

Because CFD trades are conducted using leverage the potential losses and profits could be magnified therefore, the greater you leverage the more the chance for traders to sustain heavy losses.

Guaranteed stop

Other tools for managing risk offered through this brokerage include Stop loss (“Close at risk”) as well as Limit (“Close at Profit”) options and a guarantee stop that is available for specific instruments only. Additionally traders are able to create Price alerts and trailing stops (automatically safeguarding a position’s downside while locking in its upside).

Negative Balance Protection

To make sure that their customers don’t lose more money than they’ve deposited, Plus500 provides the so known as Negative Balance Insurance (stated in the risk disclosure in their site). This signifies that your account will be reduced to zero balance should it go negative because of the volatile market that is moving at a rapid pace.

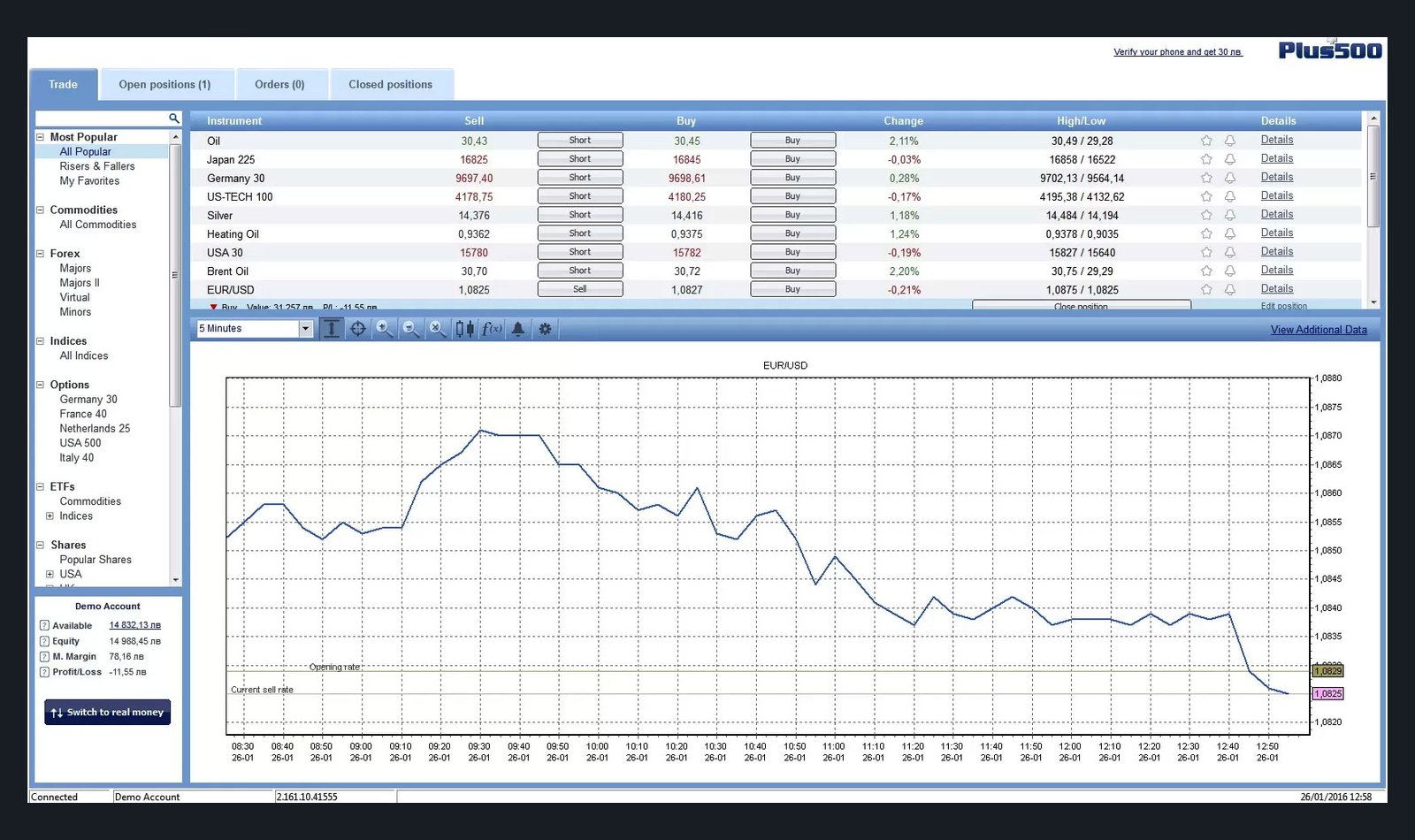

Trading Platform

In contrast to most brokerages, Plus500 offers just one trading platform to its clients. FxPro is one example. It provides up to four platforms, including MetaTrader4, MetaTrader5, cTrader and SuperTrader.

Plus500 its trading platform that is proprietary is available in over 30 languages. It provides web and desktop versions (WebTrader) and portable version (for iPhone, iPad & Apple) and also as Windows (10 and Phone) along with Android versions.

Even though MetaTrader 4 has been established as the most widely used platform to trade CFDs or spot forex, Plus500 can capture the market in a significant way because they simplify things to ensure that traders don’t suffer from the effects of overloading their information while using the platform. To keep with their minimalistic design Plus500 offers two types of account that are live and demo accounts with the demo account completely free.

Payment Methods

Clients of Plus500 can deposit and withdraw funds from and into their accounts through Credit/Debit Cards (Visa, Master Card & Maestro), PayPal, Skrill and Wire Transfer.

Conclusion

Plus500 (LON:PLUS) is an regulated and well-regulated public-owned and reputable broker for CFDs with greater than 2000 options on its simple, user-friendly platform

Plus500 Overview

| Plus500 Summary | |

|---|---|

| Plus500 Details | Information |

| Regulators | ASIC, CySEC, FCA |

| Country |  United Kingdom United Kingdom |

| Base Currencies | GBP, EUR, USD |

| Type Of Brokers | ECN, STP |

| Trading Platform | Desktop, WebTrader |

| Established Year | 2008 |

| Website Language | English, French, Italian |

| US Clients | |

| Plus500 Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | N/A |

| Commission | |

| Fixed Spreads | |

| Plus500 Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  Visa Card, Visa Card,  Master Card, Master Card,  Skrill, Skrill,  PayPal PayPal |

| Acc Withdrawal Methods |  Skrill, Skrill,  Wire transfer, Wire transfer,  Visa Card, Visa Card,  Master Card, Master Card,  PayPal PayPal |

| Plus500 Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| Plus500 Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 1:30 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | $100 |

| Islamic Account | |

| Plus500 Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| Plus500 Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | N/A |

| support@plus500.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | N/A |